Case Study Details

Australia's superannuation industry faced a significant engagement crisis.

Only 23% of super fund members actively engaged with their retirement planning.

Members struggled to navigate between disconnected systems for planning, advice, and income solutions.

Existing platforms failed to cater to diverse member needs and life stages.

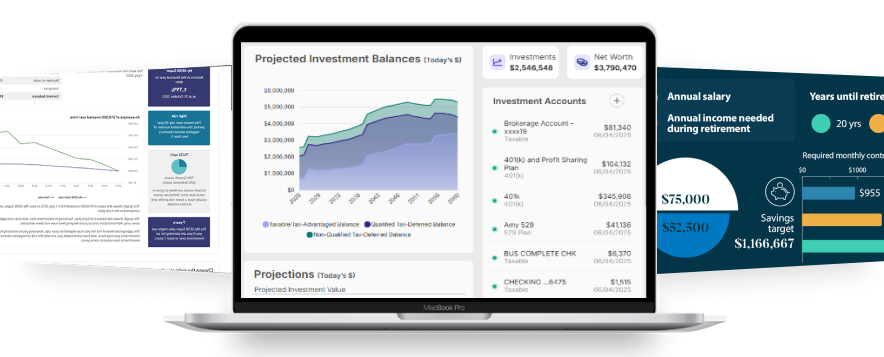

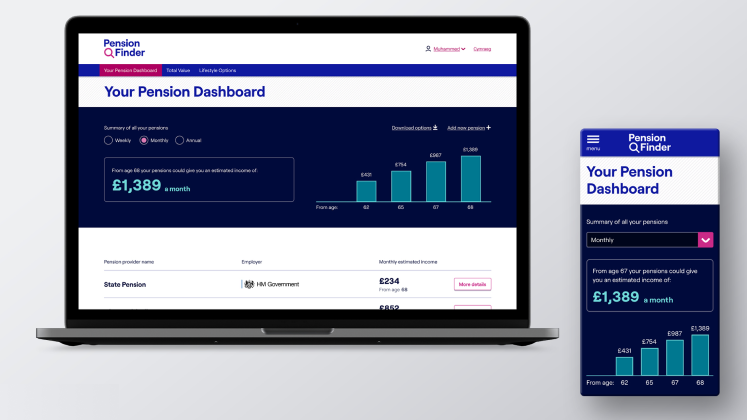

Member dashboard and portfolio overview

Retirement planning calculator

Income projection tools

Basic personalization features

Integration with legacy super fund systems

Regulatory compliance requirements (SIS Act, Design & Distribution Obligations)

Stakeholder alignment across multiple super fund clients

Accessibility requirements (WCAG 2.1 AA)

Mainly focus Desktop application with responsive design

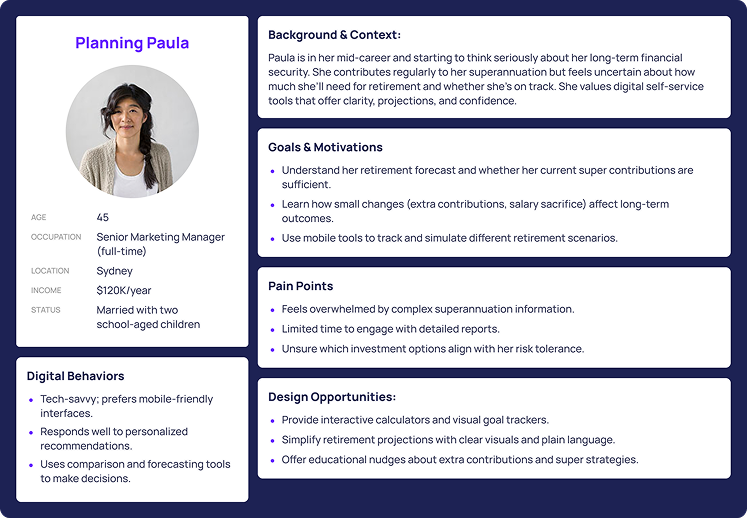

Super Fund Members (Ages 35-65)

Super Fund Administrators

Through extensive research, I developed three core personas:

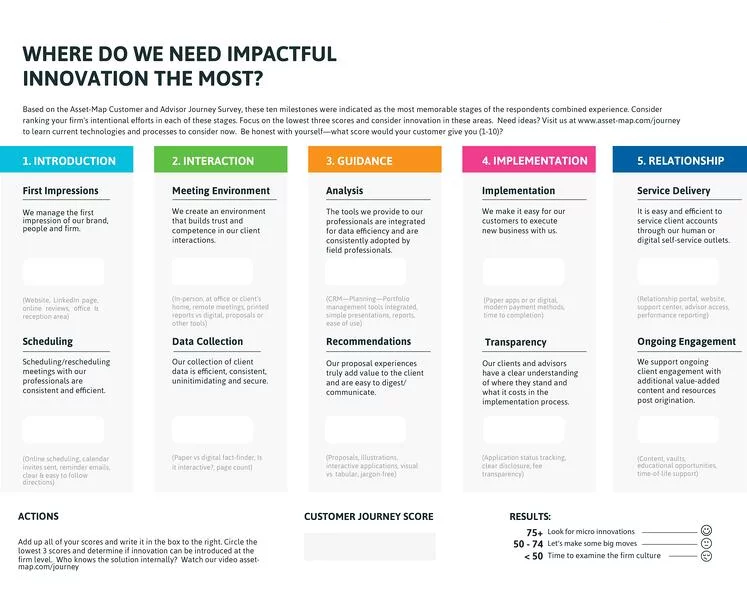

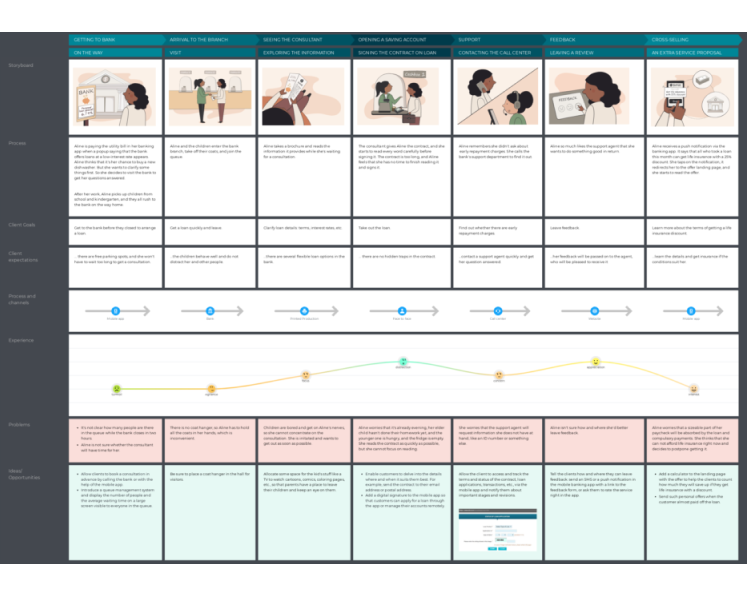

Developed comprehensive user journey maps for 3 core personas.

Created detailed information architecture spanning 45+ page templates.

Mapped cross-channel touchpoints and interaction patterns.

Designed service blueprints connecting member-facing and back-office processes.

Member journey maps with pain points and opportunity identification.

Cross-platform experience flow diagrams.

Stakeholder alignment workshops resulting in unanimous approval.

Initial low fidelity prototyping

Created 150+ wireframes using Figma.

Developed interactive prototypes for 8 core user flows.

Built responsive design system with 45 components.

Established comprehensive UI pattern library.

Created modular component library ensuring consistency across super funds.

Developed accessibility-first design patterns.

Built design tokens for seamless developer handoff.

Members reported feeling "more confident" about retirement planning.

Simplified complex financial concepts into digestible, actionable insights.

Created seamless multi-channel experience across web and mobile.

Established new benchmark for retirement platform usability in Australian market.

Accelerated future feature development by 40%.

Enabled consistent experience across multiple super fund brands.

Reduced design debt and improved development efficiency.

Discovered that transparency in calculations and clear data sources significantly increased user confidence.

Implemented progressive disclosure techniques to build trust gradually.

Learned that "show your work" approach resonates strongly with financial services users.